In today’s digital economy, offering seamless and secure payment processing is crucial for businesses of all sizes. Whether you’re an e-commerce platform, a fintech startup, or a large enterprise, the payment experience you provide can significantly impact customer satisfaction, conversion rates, and overall success. For many businesses, the solution lies in white label payment gateway—ready-made platforms that can be customized and branded as your own. But with so many options available, how do you choose the right White Label payment gateway for your business?

This ultimate guide will walk you through the key factors to consider when selecting a White Label payment gateway, helping you make an informed decision that aligns with your business needs.

What Is a White Label Payment Gateway?

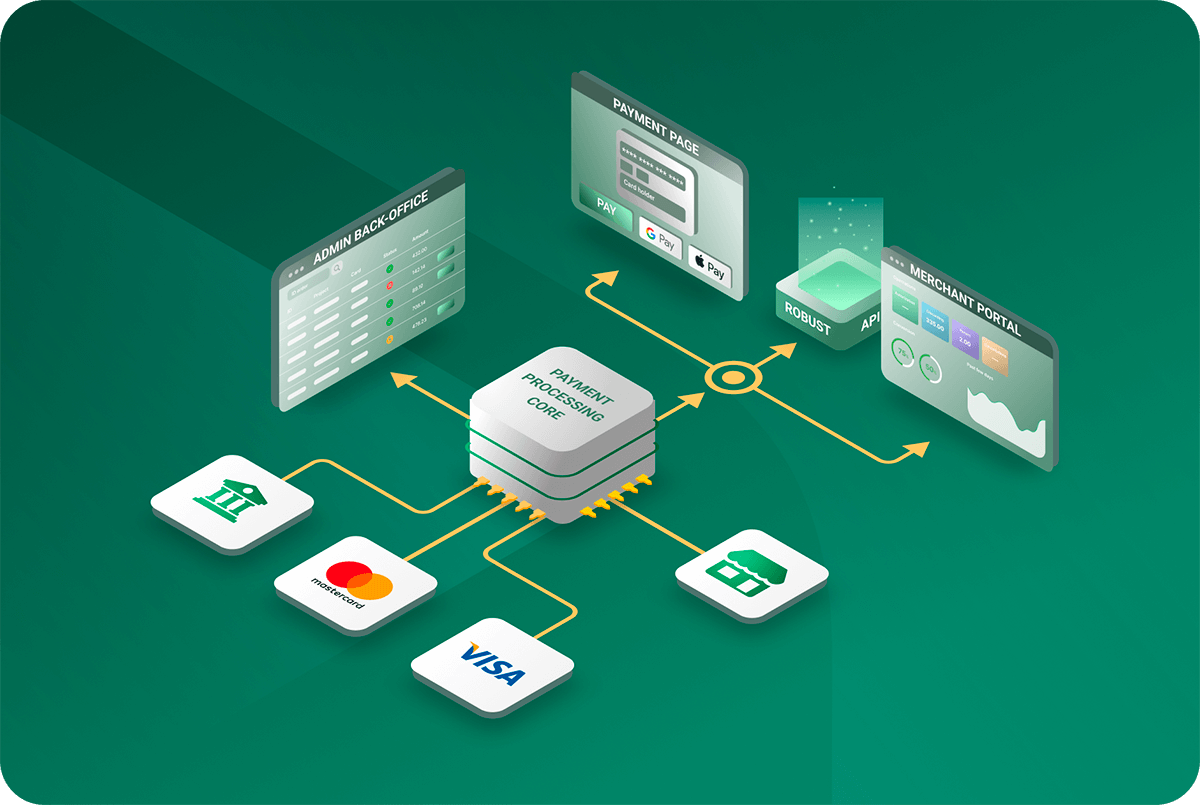

A White Label payment gateway is a third-party platform that businesses can customize and rebrand to offer payment processing services under their own name. These gateways handle the complex backend processes involved in payment transactions, including authorization, settlement, and security, while allowing businesses to maintain control over the customer experience.

White Label payment gateways are particularly valuable for businesses that want to offer payment services without the significant investment of building a payment system from scratch. By leveraging a White Label solution, businesses can focus on their core competencies while providing a seamless, branded payment experience to their customers.

Why Choose a White Label Payment Gateway?

There are several compelling reasons why businesses opt for White Label payment gateways:

- Cost-Efficiency: Developing a payment gateway from the ground up is expensive and time-consuming. A White Label solution provides a cost-effective alternative, allowing businesses to access advanced payment technology for a fraction of the cost.

- Customization: White Label gateways offer a high degree of customization, enabling businesses to tailor the payment interface, payment options, and branding to meet their specific needs and enhance the customer experience.

- Faster Time to Market: With a pre-built platform, businesses can quickly deploy their payment services, reducing the time it takes to bring new products or services to market.

- Scalability: As businesses grow, their payment processing needs become more complex. White Label gateways are designed to scale with the business, supporting higher transaction volumes and new payment methods.

- Compliance and Security: White Label providers typically offer robust security features and ensure compliance with industry regulations, reducing the burden on businesses to manage these critical aspects.

Now that we’ve established the value of a White Label payment gateway, let’s dive into the key factors you should consider when choosing the right solution for your business.

- Assess Your Business Needs

The first step in choosing a White Label payment gateway is to assess your business needs. Consider the following questions:

- What types of payments will you be processing? Determine whether you need to accept credit/debit cards, bank transfers, digital wallets, or other payment methods like cryptocurrencies.

- What is your target market? If you operate in multiple regions, you’ll need a gateway that supports multi-currency transactions and region-specific payment methods.

- What is your expected transaction volume? Understanding your current and projected transaction volume will help you choose a gateway that can scale with your business.

- Do you need recurring billing capabilities? If you offer subscription services, ensure that the gateway supports automated recurring payments.

By clearly defining your needs, you can narrow down your options and focus on gateways that align with your specific requirements.

- Evaluate Customization Options

Customization is a key advantage of White Label payment gateways. The ability to tailor the payment experience to your brand and customer preferences can enhance user satisfaction and drive loyalty. When evaluating customization options, consider:

- Branding: Look for a gateway that allows you to fully customize the payment interface with your logo, colors, and messaging.

- User Interface: Ensure that the gateway offers flexibility in designing the user interface to create a seamless checkout experience.

- Payment Methods: Check whether the gateway supports the integration of multiple payment methods and allows you to prioritize or highlight specific options based on customer preferences.

- Reporting and Analytics: Consider whether the gateway offers customizable reporting features that provide insights into transaction data, helping you make informed business decisions.

Choosing a gateway with robust customization options ensures that you can create a payment experience that aligns with your brand and meets the expectations of your customers.

- Prioritize Security and Compliance

Security is paramount in payment processing, and any breach can have serious consequences for your business. When choosing a White Label payment gateway, prioritize security features and ensure compliance with industry regulations:

- PCI DSS Compliance: The gateway should be compliant with the Payment Card Industry Data Security Standard (PCI DSS), which sets the security requirements for processing credit card transactions.

- Data Encryption: Ensure that the gateway uses advanced encryption methods to protect sensitive customer data during transmission and storage.

- Fraud Detection: Look for gateways that offer AI-driven fraud detection and prevention tools to identify and mitigate fraudulent transactions in real-time.

- Two-Factor Authentication (2FA): Consider gateways that support two-factor authentication for added security during the payment process.

- Compliance with Local Regulations: If you operate in multiple regions, ensure that the gateway complies with local data protection and payment processing regulations, such as GDPR in Europe or the RBI guidelines in India.

By selecting a gateway with strong security features and regulatory compliance, you can protect your customers’ data and build trust in your payment processing capabilities.

- Check for Scalability and Performance

As your business grows, your payment gateway needs to handle an increasing number of transactions without compromising performance. Scalability is crucial, especially for businesses expecting rapid growth or operating in high-volume industries like e-commerce.

- Transaction Volume: Ensure that the gateway can scale to accommodate higher transaction volumes as your business expands.

- Response Time: Look for gateways with low latency and fast processing times to ensure a smooth checkout experience for your customers.

- Global Reach: If you plan to expand internationally, choose a gateway that supports multi-currency transactions and cross-border payments.

- Downtime and Reliability: Check the gateway’s track record for uptime and reliability, as any downtime can result in lost sales and frustrated customers.

A scalable and high-performance gateway will enable you to maintain a seamless payment experience as your business grows and your transaction volumes increase.

- Consider Customer Support and Integration

When implementing a White Label payment gateway, access to reliable customer support and seamless integration capabilities are essential:

- Integration: Ensure that the gateway can easily integrate with your existing systems, such as your e-commerce platform, CRM, or accounting software. Look for gateways that offer APIs and SDKs for smooth integration.

- Customer Support: Choose a provider that offers comprehensive customer support, including 24/7 assistance, technical support, and dedicated account management. This is particularly important during the setup phase and when troubleshooting any issues that may arise.

- Training and Documentation: Consider whether the gateway provides training resources and detailed documentation to help your team get up to speed with the platform quickly.

A provider with strong customer support and integration capabilities will make the implementation process smoother and ensure that any issues are resolved quickly.

- Compare Pricing Models

Finally, it’s important to consider the pricing structure of the White Label payment gateway. Pricing models can vary widely between providers, so it’s essential to choose one that fits your budget and business model:

- Setup Fees: Some gateways charge an upfront fee for setup and customization. Ensure that you understand these costs before committing to a provider.

- Transaction Fees: Most gateways charge a fee per transaction, which can be a flat rate or a percentage of the transaction value. Compare these fees across different providers to find the most cost-effective option.

- Monthly Fees: Some providers charge a monthly subscription fee, which may include a certain number of transactions or features. Be sure to understand what is included in this fee and whether it aligns with your expected usage.

- Additional Costs: Look for any hidden fees, such as charges for chargebacks, refunds, or additional features.

By carefully evaluating pricing models, you can choose a gateway that offers the best value for your business while ensuring that you can maintain profitability.

Conclusion: Choosing the Right White Label Payment Gateway

Selecting the right White Label payment gateway is a critical decision that can significantly impact your business’s success. By considering factors such as customization options, security features, scalability, customer support, and pricing, you can choose a gateway that aligns with your business needs and helps you deliver a seamless, secure, and branded payment experience to your customers.

Payomatix offers a comprehensive White Label payment gateway solution that meets all the criteria outlined in this guide. With advanced security features, robust customization options, and exceptional customer support, Payomatix provides businesses with the tools they need to succeed in today’s competitive digital economy.

If you’re ready to enhance your payment processing capabilities with a White Label solution, consider Payomatix as your trusted partner. Contact us today to learn more about how our platform can help your business grow and thrive.

icons at the top right corner of the subsection.

icons at the top right corner of the subsection.